With interest rates at historic lows – and predicted to stay low for some time – new home construction is on the rise nationwide as supply struggles to meet demand.

There is good news in what has otherwise been a year fraught with economic doom and gloom, and one of those bright spots is the residential housing market. According to National Association of Home Builders (NAHB), which analyzes data gathered by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, housing demand is staying the course on its upward trajectory with sales consistently beating last year’s impressive numbers.

“Historically low mortgage rates, favorable demographics, and an ongoing suburban shift for home buyer preferences have spurred demand and increased new home sales by nearly 17% in 2020 on a year-to-date basis,” says NAHB Chairman Chuck Fowke. “Though builders continue to sign sales contracts at a solid pace, lot and material availability is holding back some building activity. Looking ahead to next year, regulatory policy risk will be a key concern given these supplyside constraints.”

The NAHB reports that regionally, on a year-to-date basis, new home sales are up in all four regions: 22.5% in the Northeast, 25.9% in the Midwest, 14.4% in the South, and 18% in the West. In addition, the latest NAHB/ Wells Fargo Housing Market Index (HMI) released mid-November reveals builder confidence levels in the new construction single-family homes sector have hit successive all-time highs over the past three months, increasing five points to 90 in November, shattering the previous all-time high of 85 in October.

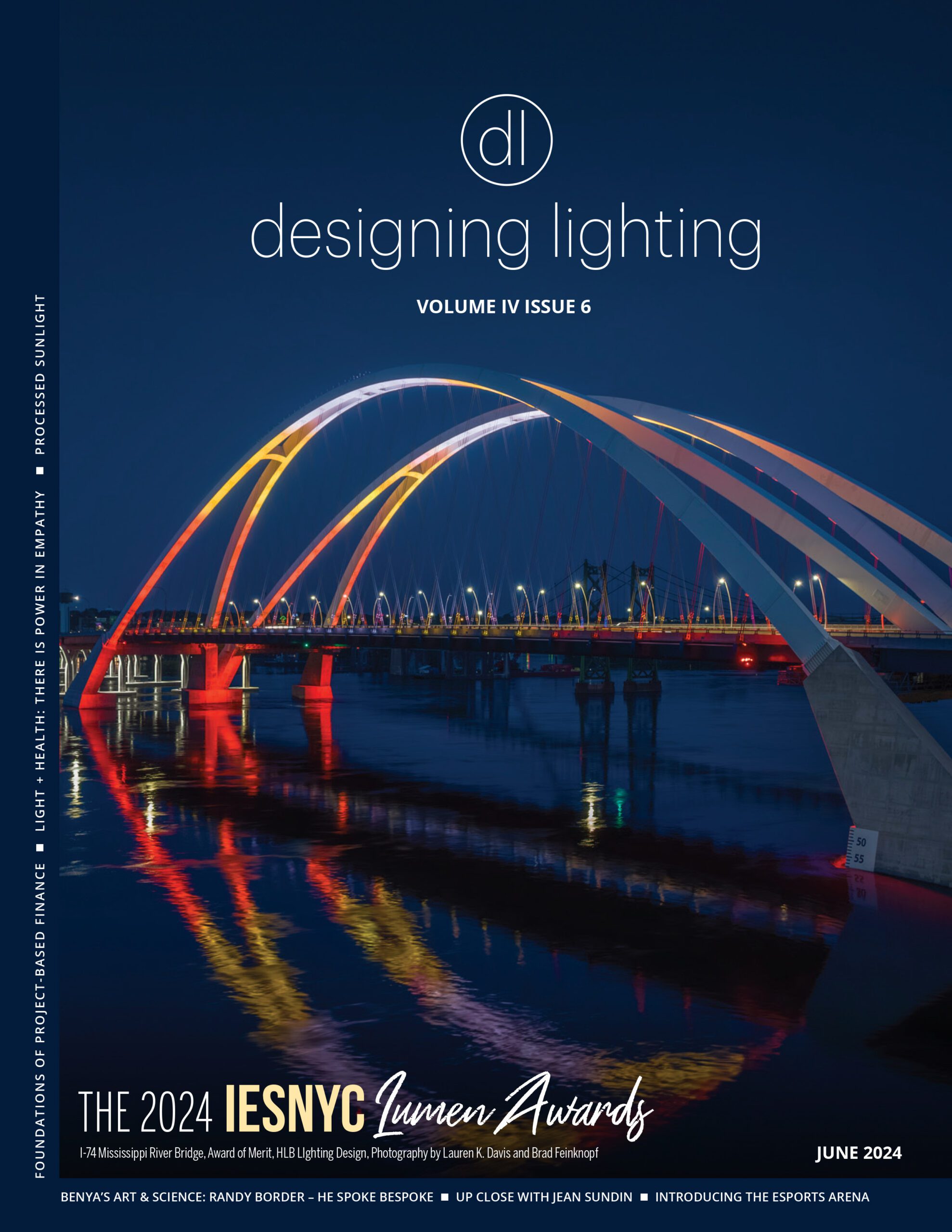

Photo credit: designing lighting

Lighting Showrooms Report Brisk Sales

“In short, builder business has been phenomenal even in the wake of the pandemic,” admits Donovan Turney, who just relocated from the Light Ideas showroom in Florida to Hermitage Lighting Gallery in Nashville for an opportunity to further expand the latter showroom’s success in the housing sector. In Florida, Turney says the showroom experienced record numbers in spring and summer and the same growth is happening in the greater Nashville area with no signs of slowing.

For lighting distributors that do the majority of their business in builder packages and new construction – no matter which region of the country they serve – the sector has been thriving, even when most of the country’s retailers were shut down for in-person sales. The reason is two-fold: not only are interest rates at record lows, but builders do not need to come into a showroom and spend considerable time picking out individual pieces like a homeowner would. “Most of what [the larger builders] are buying are predetermined packages that we set up for them with our preferred vendors,” Turney explains.

“Turney says the showroom experienced record numbers in spring and summer and the same growth is happening in the greater Nashville area with no signs of slowing.”

Lights Unlimited in North Carolina had a similar experience with its showrooms. While the stores were closed to walkin business in the spring, employees were able to take phone and email orders plus bundle builder orders for curbside pick up while social distancing appropriately. For custom, luxury home builders – whose product selections are much more tailored to the individual home buyer – video technology took the place of face-to-face meetings.

On the flip side, those lighting showrooms whose revenue is heavily reliant on walk-in foot traffic – whether by consumers or interior designers – were hardest hit financially during the spring and summer months as delayed reopening and occupancy limitations significantly impacted their profitability. As those restrictions lifted, however, business has reportedly returned to pre-COVID levels.

“By and large business is good across the board,” notes Lisa Bartlett, owner of Pace Lighting in Savannah, Georgia. “Housing and construction didn’t stop in most places, and for many of us it even picked up! There are exceptions to be sure, but mostly showrooms are doing well and some are even having recordsetting years.”

Photo credit: Joe Ciciarelli

Bartlett reports that consumer walk-in traffic has also returned. “There is still a fair amount of browsing, but most of that browsing converts to sales — which was not the case pre-pandemic,” she states.

As the founder of the Lighting Showroom Association (LSA), which began as a grassroots networking group of independent lighting showrooms across the U.S. and Canada, Bartlett was able to negotiate drop-shipping terms and free freight allowances among major lighting manufacturers for the LSA membership. The move allows lighting retailers to better compete with online distributors who offer consumers free shipping along with attractive price points for similar products.

“These programs have helped our instore business a lot,” Bartlett explains. “It depends on the geographic area, but we have some customers that drive one hour or so to shop in our store. They are thrilled that we can ship their order direct to their homes for no extra charge, and they don’t have to make a return trip to pick something up, and I’m thrilled that I don’t have to pay a delivery driver! These programs also allow us to get product faster, which is critical. Amazon and other online stores have consumers 100% convinced that receiving product two days after you order it is a completely normal and feasible thing, so we have to at least come close to that mark.”

At a particular disadvantage are the small lighting showrooms that rely upon in-person sales and do not have an ecommerce-enabled website. Since the pandemic began, however, the percentage of showrooms that do not offer a digital shopping cart has been decreasing as those owners have scrambled to sign on with third-party providers who can supply that capability.

Bumps in the Road

Shortages in lumber and other building materials may slow the speed of construction growth in the months ahead. As NAHB’s Dietz points out, “Affordability remains an ongoing concern, as construction costs continue to rise and interest rates are expected to move higher as more positive news emerges on the coronavirus vaccine front. In the short run, the shift of housing demand to lower-density markets such as suburbs and exurbs with ongoing low resale inventory levels is supporting demand for home building.”

Photo Credit: designing lighting

Bernard Baumohl, chief global economist at the Economic Outlook Group, shared a similar viewpoint during his keynote session at the recent American Lighting Association (ALA) Virtual Symposium. “Home builders are showing the greatest optimism they’ve had in many years. We see the same thing in the existing home market, which makes up 85 percent of the housing market,” he states. “There’s been a really big bounce from people taking advantage of the low interest rates. When mortgage rates drop to less than 3 percent, everybody gets off the fence and buys homes that they can afford. The problem is, because there’s such a scarce inventory, it has caused prices to reach record high levels.” Overall, the strength of the housing markets provides good news for the lighting industry. “We’re expecting to see a good bounce for the kinds of household items [lighting showrooms sell] based on the housing market numbers,” Baumohl says.

Aside from the construction market, he cautions, “We’re going to have to brace ourselves for what is about to unfold socially and economically. The whole economic and business landscape has really been shaken up in a way we haven’t seen since The Great Depression. We cannot fix the economy until we fix the health crisis. We’ve had some positive economic news lately with retail sales coming back, but I want to caution everybody. An economic rebound is not the same as an economic recovery. We have to guard ourselves against a false sense of security. Just be prepared. The virus is still calling the shots when it comes to where the economy is going.”

Taking a general economic overview, Baumohl shares, “During the 2007- 2008 financial crisis, it took seven years for the Senate to move up short-term rates. It will take years for the labor market to overcome the damage done by COVID-19. It’s probably going to take 5 to 10 years before we’re at pre-COVID levels in employment and the economy — and it’s going to depend on a number of factors such as the effectiveness of the vaccine and the stimulus package coming out.”

Photo Credit: designing lighting

Looking further down the road, Baumohl sees deglobalization on the horizon as a result of recent tariffs affecting imports from China over the past two years with no reversal in sight. “Companies have learned that the international trade environment has changed,” he explains. “China is no longer the world’s manufacturing center because of the tariffs and the higher wages as well as the geopolitical risk of keeping their plants there. And those companies that have plants there, or rely on imports from China, have been burned because they have to pay the higher tariffs.”

In fact, since the first tariffs were imposed in early 2018, lighting manufacturers have been looking elsewhere to either relocate their plants or seek new suppliers in places like Vietnam, Sri Lanka, Indonesia, and Bangladesh — and quite a few have already successfully made the transition. “The problem is that a lot of these countries don’t have the skilled labor, equipment, or quality control needed or the infrastructure to transport those goods on railways and into ports,” Baumohl comments.

Baumohl predicts that some form of domestic manufacturing could increase as more lighting and furniture manufacturers consider repatriating their supply chains now that the economics have changed in foreign labor and freight costs. “Part of the equation in this decision is to look at some of the new technologies in the United States such as artificial intelligence, robotics, and 3D printing,” he remarks. “That could change the cost structure of operating in the U.S. and also create greater alliance with your supply chain because they are based in the U.S. as well. This is some of the new thinking that we’ll be seeing more of. The big questions are whether companies will have to charge more for their products – since it’s more expensive to operate in the U.S. – and will American customers be willing to pay more for products made here.”

This article originally appeared in the February issue of designing lighting