Smart technology is available to make consumers’ lives easier, but are they ready for it? The answer is complicated.

“Momma” and “Dadda” are still the first two words an infant learns to say, but “Alexa” and “Siri” might follow quickly after. Today’s younger generation has grown up with technology and is quite comfortable with relying on it to perform a wide variety of tasks daily. While their Baby Boomer and Gen X parents have accepted technology for some things, many remain wary about installing an all-inclusive wireless technology solution.

Instead, consumers in the over-50 demographic prefer to dabble in the “smart home” category with a more piecemeal approach. They are comfortable purchasing enormous Roku TVs to stream movies over the internet (using Netflix, Hulu, etc.), but may only add one “smart” lightbulb or one voice assistant (i.e. Amazon Echo/Alexa or Google Nest) in the entire house.

A study released by the Consumer Technology Association® (CTA) last year noted one-third (31%) of U.S. homeowners said they were likely to purchase tech products during 2021 despite any uncertainty brought on by the pandemic. What are they buying? According to CTA research, the smart home technologies that gained the most household penetration are in categories such as smart speakers, smart lightbulbs, and smart doorbells — and most of those sales are coming from repeat customers adding devices to their existing networks versus first-time tech buyers.

Builders and real estate agencies have embraced smart technology in their offerings, defining a “smart home” as one that offers networked products such as heating and cooling, lighting, security, and entertainment through either a mobile device or by a separate, inclusive system.

Realtor® magazine analyzed the smart home packages presented by several national builders and discovered a potpourri of brands included in each model. For example, Pulte’s starter smart-home package includes CAT6 wiring in the family room and wireless access points connected to a central location for setting up a home network. “The actual router and access points are not included, and additional CAT6 wiring is charged per room. The upgrade package includes voice control, a wireless access point from Ubiquiti, Nest thermostat, Liftmaster garage door, and a Schlage front door lock. À la carte options include smart switches from Leviton, speakers from Sonos, and other various AV solutions,” the magazine reports.

According to the Realtor research, builder D.R. Horton has partnered with subscription-based Alarm.com as a part of its Home Is Connected program with a base package offering a Honeywell thermostat, Skybell doorbell, and Kwikset lock connected to the Qolsys IQ panel.

Meanwhile K. Hovnanian Homes, Realtor notes, offers a smart-home package with Brilliant Controls that includes a Brilliant Control panel, Ecobee thermostat, Ring doorbell, and Amazon Echo Dot with no subscription service required.

While the builder and real estate industries were ready to tout smart home benefits, the pandemic altered that trajectory. As a result of building materials shortages and historically low-interest rates, whether a new home is equipped with a smart home package or not is no longer the selling point that real estate agents, builders, and even lighting professionals had predicted it would be back in 2018 and 2019 when demand was expected to skyrocket in 2020 and 2021.

With new home sales stalled as demand outpaces supply, remodeling activity has surged. This bodes well for lighting showrooms who have invested in smart home solutions. Their challenge, however, is the considerable competition they face from big box retailers, electronics stores, and online sellers. It’s not just a price war, but a bid for recognition. Lighting showrooms struggle with achieving visibility as a smart home product provider.

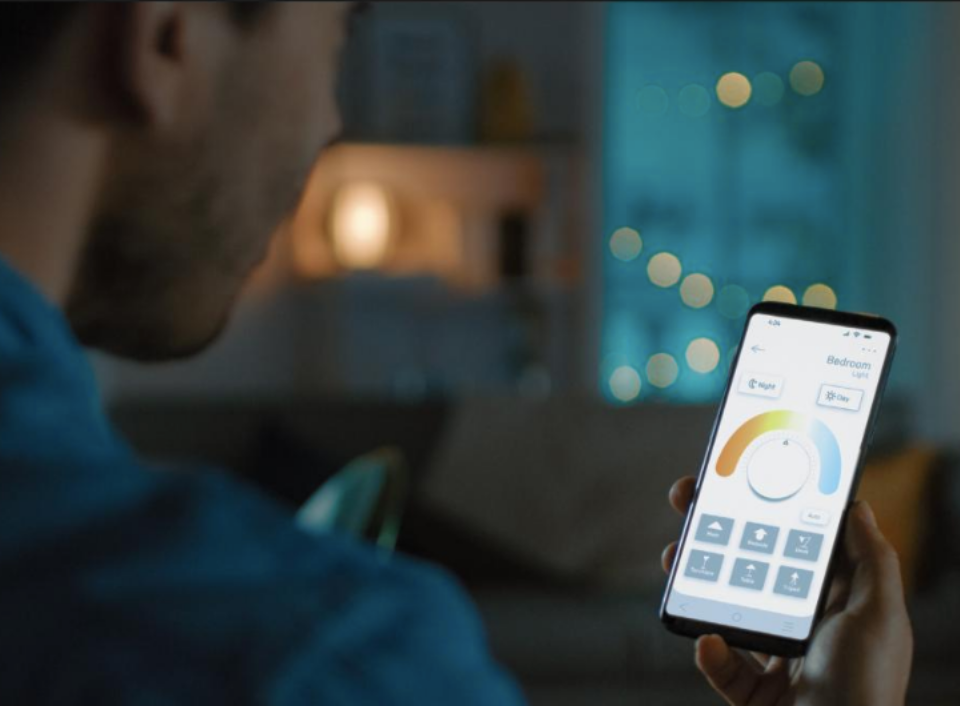

“We sell and promote smart lighting controls,” says Natalie Green, a sales associate at Ohio-based Gross Electric, who is also a certified Lighting Specialist from the American Lighting Association (ALA). “Consumers are always looking for another way to make their lives easier and with smart lighting controls you can do that,” she explains. “When it comes to lighting controls, people like them because they are easy and convenient. They can control their lights from their phone, turn off their whole house with just one button, and so many more options.”

Awareness of smart products has been growing, according to Green. “Not everyone comes in asking about lighting controls, but a lot of people do. It’s something we promote to our customers just so they are aware of all of the possibilities,” she comments. “There are many different lighting systems available, but it’s all about finding what is the right system for the customer.”

“Smart lighting was the first to be a smart consumer product because it was simple, fun, and the results were almost instantaneous and highly visible. It was a plaything, and the availability of smart bulbs with a phone app made it an easy package to sell,” explains Terry McGowan, FIES, LC, principal of Lighting Ideas and Director/Engineering for the ALA. “The variations of smart bulbs have resulted in bulbs with microphones, speakers, batteries, and various kinds of sensors so that they automatically turn off or on when people are near, when daylight goes away, or when the power fails. I believe lighting is the key to the integrated home. A few showrooms have already figured it out and I see opportunities for other approaches — especially as electric utilities become more active in the integrated home industry.” Angela Fielden, co-founder of Simply Floors and Lights in Texas, has been researching the smart home category with an eye toward expanding her showroom’s offering. “Starfish from Satco and Bulbrite’s Solana smart bulbs have gotten interest; however, I am finding many customers have already installed a smart home system and just want to find compatible lighting to go with it.”

Lisa Bartlett, owner of Pace Lighting in Savannah, Ga., is hesitant to delve deep into smart home systems. “It’s not because I don’t want to sell it, but I think it would take a heavy marketing push in order to have people come to my lighting showroom expressly for smart home tech,” she remarks. “It’s just nowhere near top of mind for consumers to equate a lighting showroom with smart home. I think our best entry into this category is through Satco’s Starfish and Legrand’s products. That way, it becomes a smart lamp and smart device that we are adding on to the sale. But the class of whole-home smart solutions? Those are mainly sold by AV installers.”

McGowan points out that Urban Lights showroom in Denver has been working with A/V system integrators to not just learn about smart products, but also understand how the consumers view those products in the context of integrated homes. “That sounds like a great approach – to learn from those already participating in the space and to be ready with top-notch lighting products and application knowledge,” he says.

Lighting manufacturers who serve the showroom channel have created user-friendly products and collateral materials designed to build awareness among end-consumers and speed adoption. These products can be set up by the homeowner within minutes of opening the box. Many of these versions have RGB and Tunable White capability built-in, along with pre-set or scheduling ability, as well as voice operation using Amazon Alexa and Google Home.

While these products can also be purchased online, the differentiator in buying from a lighting showroom lies in the level of education that a trained associate can provide. For example, quite a few brands have imagery on the package or in the marketing material touting “wellness” as a benefit of tunable white lighting without detailed explanation of how to implement the process at home.

If lighting showrooms can overcome the hurdle of heightening consumer awareness of their stores as a resource for smart home products and integration, this category will become increasingly important – and profitable – to the lighting showroom channel.

This article was originally featured in the August issue of designing lighting (dl)